Bullet Journal Budget Tracker Ideas To Organize Your Finances

Today we will finally tackle finances and what Bullet Journal page ideas can help you organize your money.

For someone like me, who definitely has a shopping addiction, especially if we are talking about stationery shopping, financial spreads are a must-have.

I’ve been doing my finances mostly on Google sheets, but the deeper I went into a hole of money management, the more I realized how much better it would be to actually use my Bullet Journal.

So here we are; I’ll be sharing with you all the ideas to bring financial planning to your Bullet Journal and will start doing the same myself!

Keeping up with money sounds like a very daunting, scary, and boring chore, but believe me, it’s not as bad as it sounds.

Of course, when you sit down to get organized the first time it might take a while, but once you have your system cracked – it will be easy as pie! (now I want some pie…)

Keeping an eye on your finances can help you so much!

First of all, it will help you to be better at paying your bills and covering up your debt. If you’re in the USA – paying off stuff on time will help you get a better credit score and that of course leads to tons of awesome perks.

By managing your finances, you’ll also be able to save up more for your dream house or maybe that amazing 5-star luxury vacation. With just minimal effort, you’ll discover that you can save and afford many more things.

Before we get into Bullet Journal pages to help you make it work, let’s look at your financial situation.

This post may contain affiliate links. They will be of no extra expense for you, but I receive a small credit. Please see my Disclosure for more details. Thank you for supporting Masha Plans!

Discover Where You’re At

To develop a financial system that works for you, you have to first ask yourself some tough questions.

Get a cup of tea and your comfy blanket, grab your pen and journal and brainstorm a bit about where you’re at with your finances and what you need help with.

It can be pretty scary to admit that, for example, you didn’t really need those 2 new sets of Tombow that were on sale and could’ve instead saved that money. But that’s ok – just be honest with yourself!

Totally something I did, yup. I have complete control over my stationery shopping.

But back to our analysis, here are a few questions you might want to ask yourself:

- What are my current financial struggles?

- How do people I admire manage their money? (here I probably mean people whose financial management you admire, rather than just their personality. Even though it can totally be both)

- What are some of my financial goals?

- What habits do I want to develop when it comes to money management? (like a habit of tracking your expenses can absolutely do wonders for you!)

- What are some money habits I need to get rid of?

With the help of these questions you’ve probably already figured out what’s up and where you need help, so let’s get into different financial Bullet Journal page ideas to help you.

Choose A Time Period

Just, one more thing!

The thing is – your Bullet journal is versatile and you can use it however you want. The same goes for financial spreads and trackers.

There are tons of options for you to monitor your finances:

- Weekly

- Bi-weekly

- Monthly

- By quarter

- Half a year

- Yearly

Which format should you choose? I don’t know. Different things work for different people. My best tip would be to try it all and see what works.

Personally, weekly and bi-weekly is not an option I like – it’s too often and it doesn’t give a proper overview of expenses.

My choice is to track monthly. Since my paycheck also comes on a monthly basis, it helps me to get a better picture of what’s happening with my money.

Quarter, half a year, or yearly is a bit too long for me, but who knows, it might be the perfect time frame for you!

Ok, now we are ready; let’s look into the pages.

Expense Tracker

Ok, this is the obvious one, but you definitely will get so much out of this simple exercise!

Nowadays when a lot of payments are cashless, it’s easy to lose track of money and overspend on things you don’t really need.

If you have an expenses tracker, you’ll basically be able to clearly see your spendings habits and how you can improve them.

It will also help you to stay within a budget and now overspend since you’ll always have the number in front of you.

I usually use apps to track my expenses, which is very easy especially if you’re in the USA – just connect your bank card, and you’ll see all the tables done for you.

For my daily expenses, I use a mobile app, but then I actually put the final daily numbers in my Bullet Journal. This assures that I paid attention to the numbers and actually being mindful of how much I spent and on what.

Check below for some more inspirations for the Bullet Journal expense tracker.

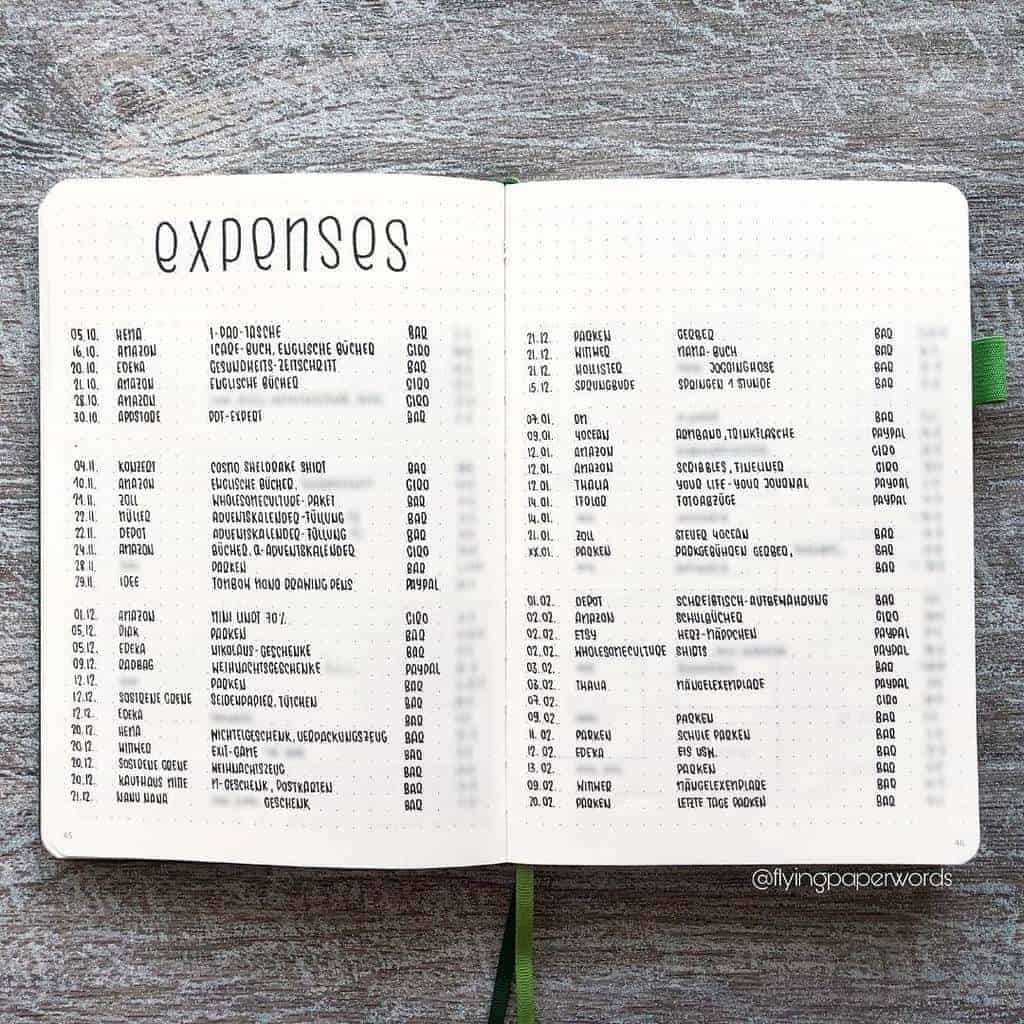

Beautiful lettering on the header of this page!

And I really like how all the expenses are divided into different categories. It’s always useful when you later analyze what exactly you spend your money on.

I always love the pages by Flying Paper Words, the handwriting is always so perfect I can’t stop admiring it.

If you’re also obsessed with improving your handwriting, be sure to check my post 9 Easy Tips To Improve Your Handwriting.

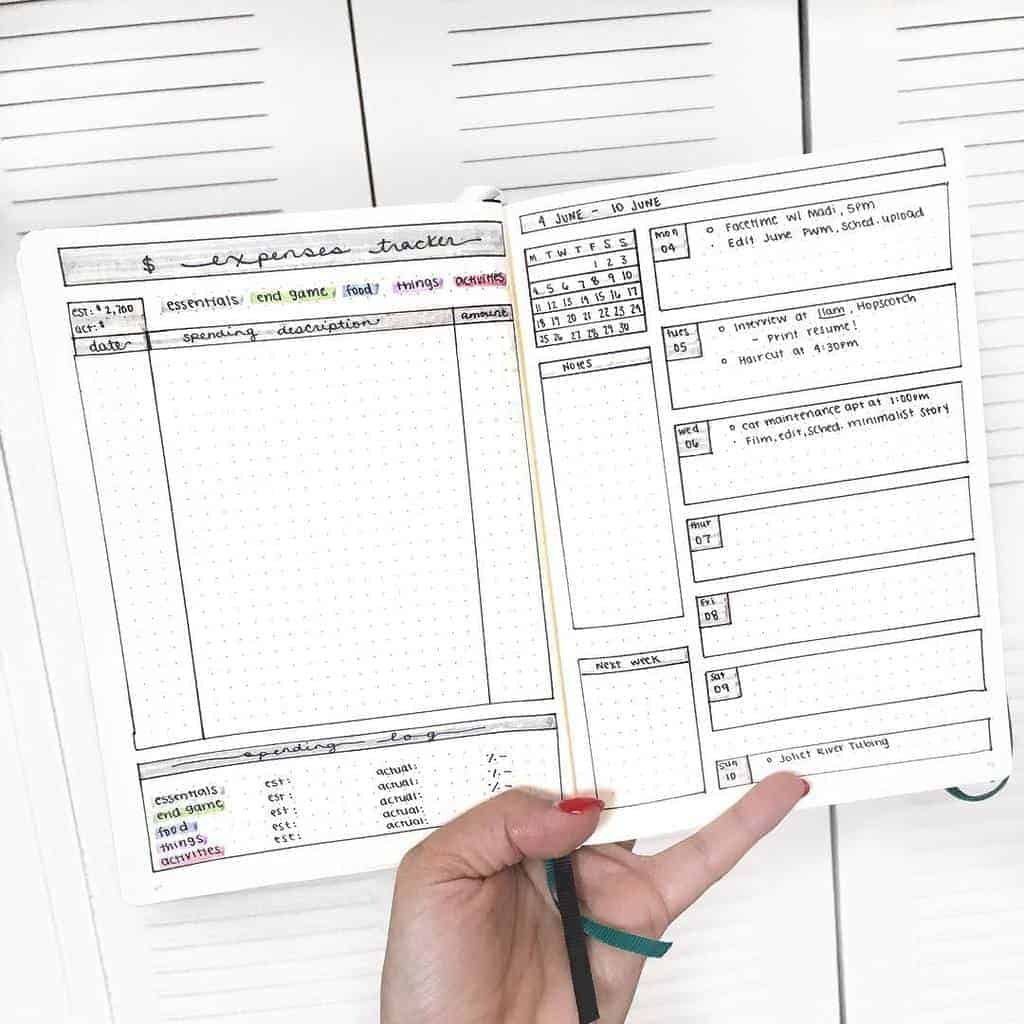

There are a few things that I really love about this tracker.

First of all, I like how the expenses are divided by categories and color-coded. Secondly – I really like that there is a final count of all expenses at the bottom of the page.

Little things like that are so very helpful when it comes to monitoring and analyzing your expenses.

Beautiful brush lettering and such a gentle spread, absolutely love it!

I really like to have the color lines like these, I feel like it makes the empty page look better. Plus it also helps you when filling out – you always know what line you’re at.

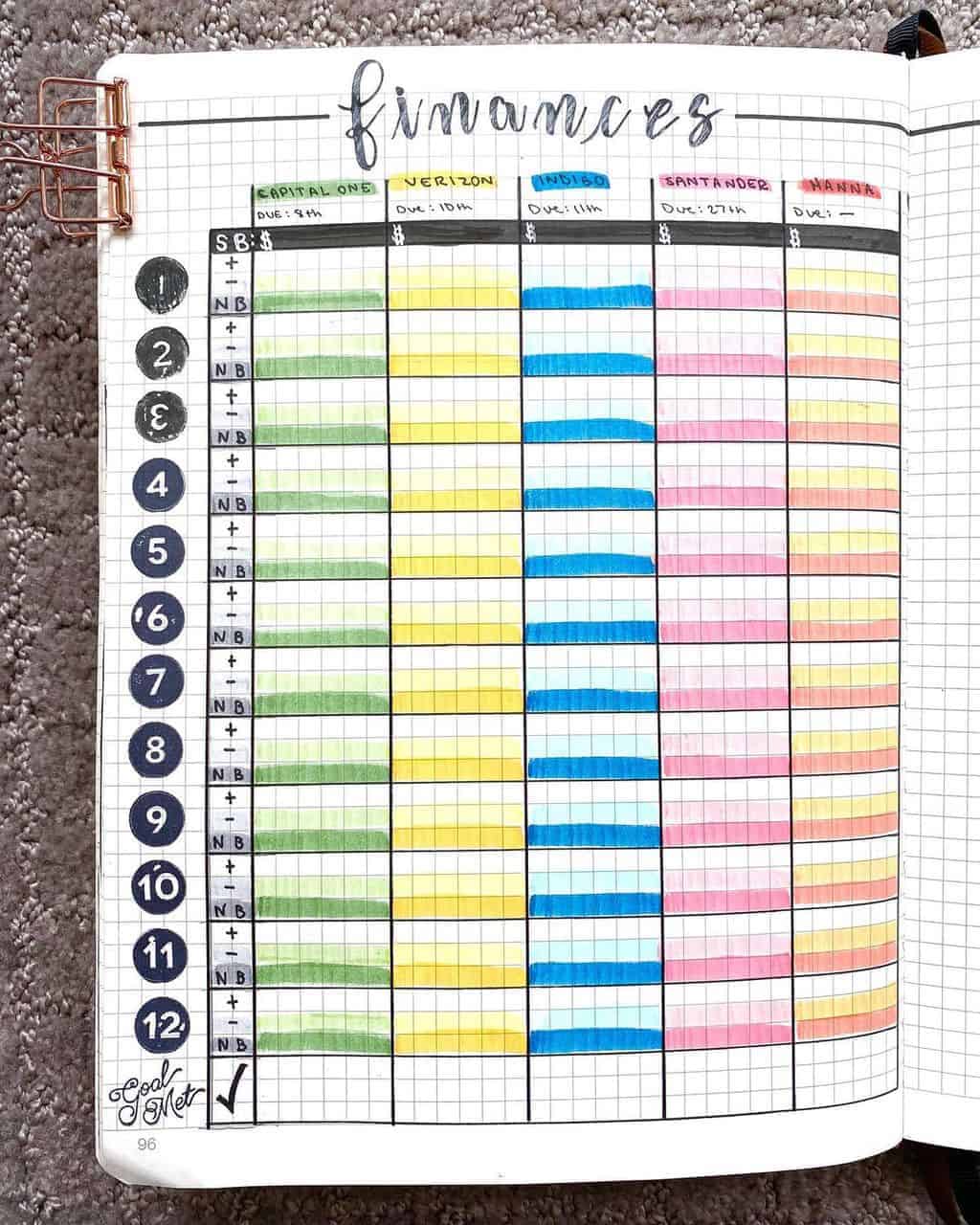

Bullet Journal Bill Tracker

Paying your bills on time is a must and can be beneficial for you, allowing you to grow your credit score, get better loans, and generally sleep calmly knowing you got it all covered.

But chances are, you have a lot of different bills to pay, and it can be daunting and confusing to remember it all.

I always struggle with that since I have different bank accounts in different countries to pay different bills, so I always need to remember when and from which card they will charge me, so I make sure I have enough money in the account.

Ok now I re-read that it totally sounds a bit shady, but it’s not like I’m evading taxes or anything. That’s just a reality of expat life; not all the things when it comes to international payments are available to me in just one country, so I have to juggle.

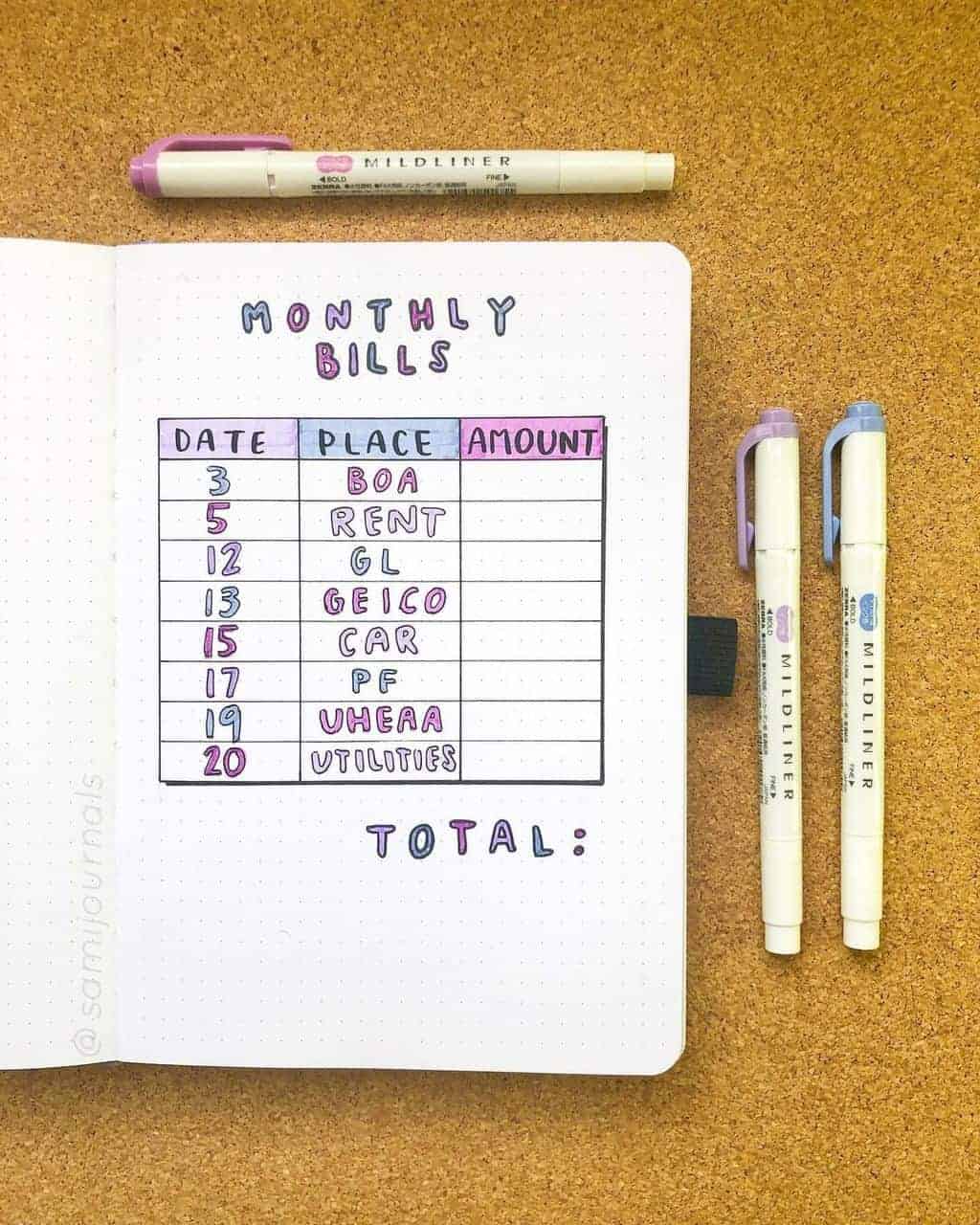

Knowing when your bills are due and how much will help you manage better your finances, plan better your expenses and never forget to pay those.

Here are a few more inspirations for bill tracker Bullet Journal pages. As you can see, that can be very good-looking.

Just look how cute this bill tracker is! It really has a Japanese vibe to it.

I also really like that she used icons for different types of bills. I’m always up for using some icons to make it easier to work with information.

For more of my ideas on icons check my post 7 Clever Ways To Use Icons In Your Bullet Journal.

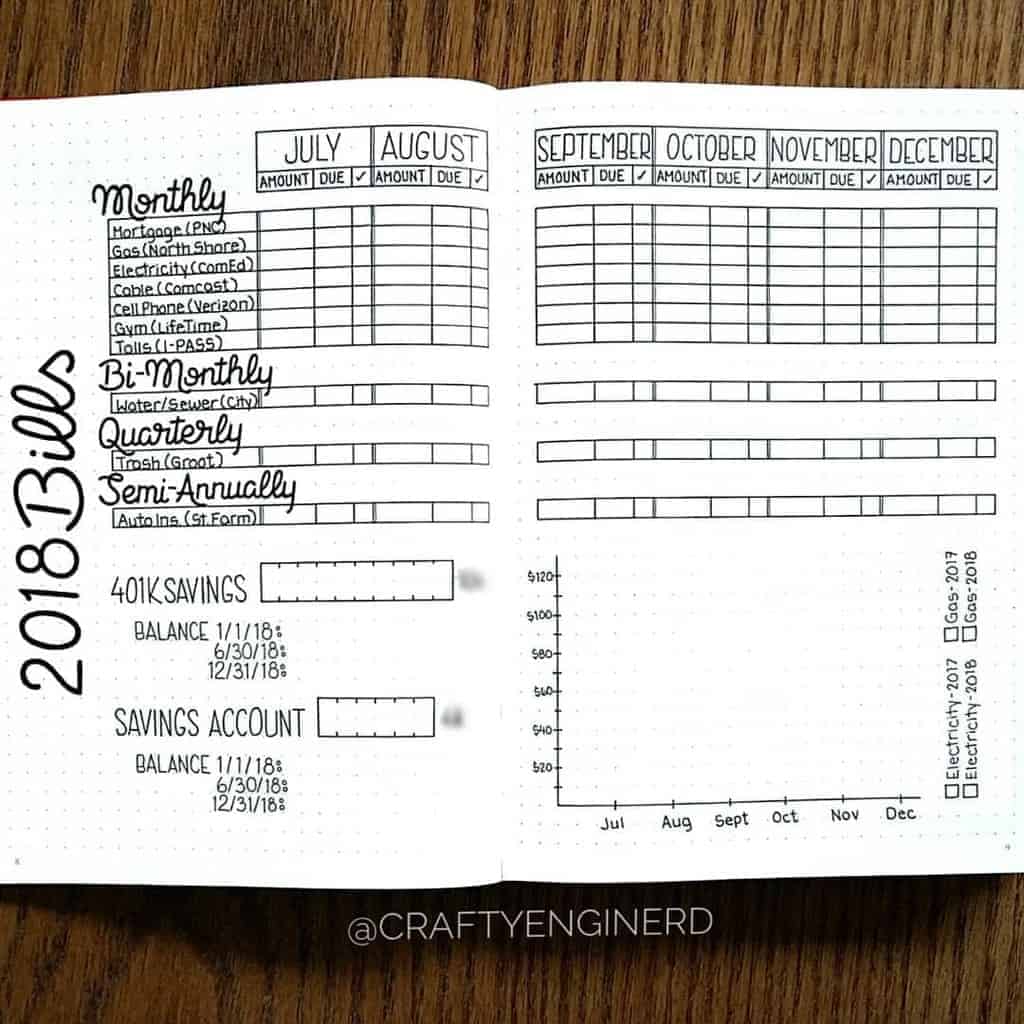

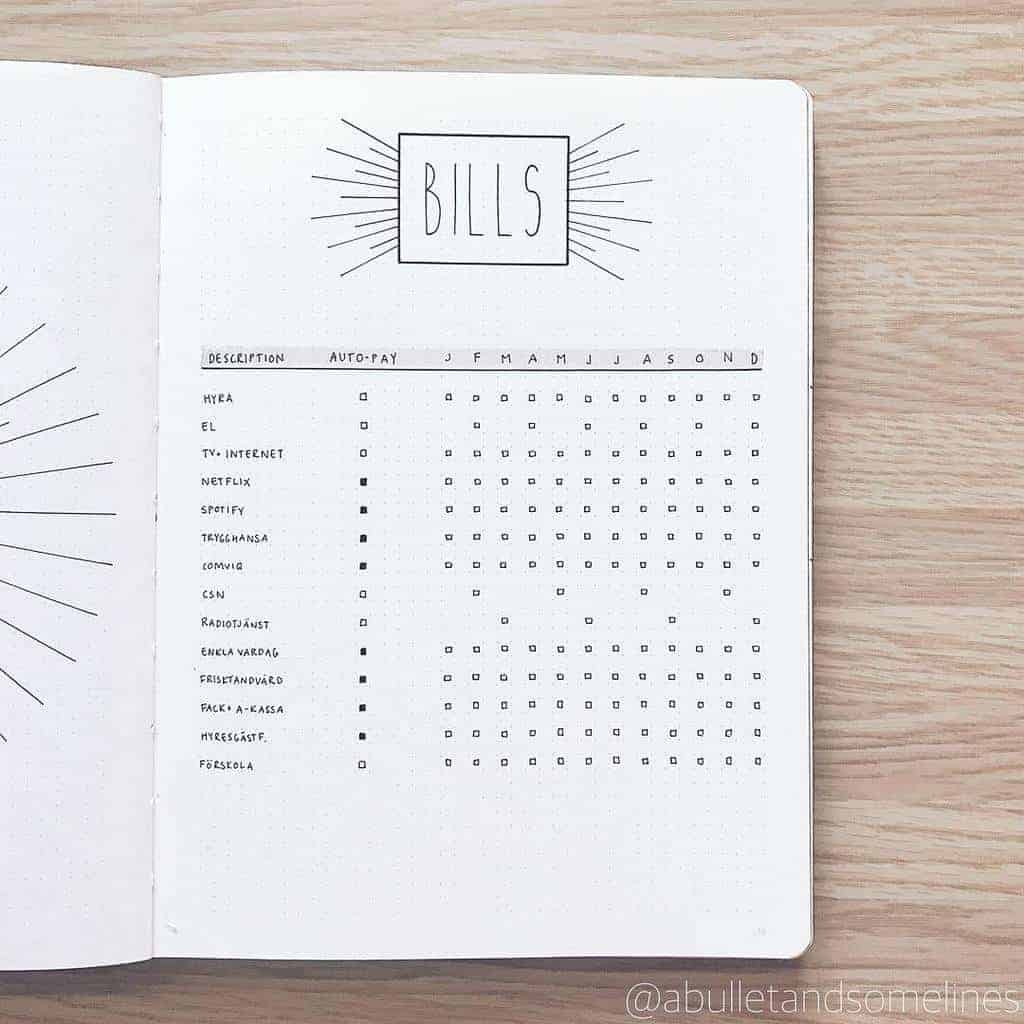

If you want to do annual bills tracker – this page is a great inspiration. I love how neatly all bills are included here.

For me, it wouldn’t work since, for some reason, I always have some random bills changing during the year. But if your life is more stable – this can be a good option.

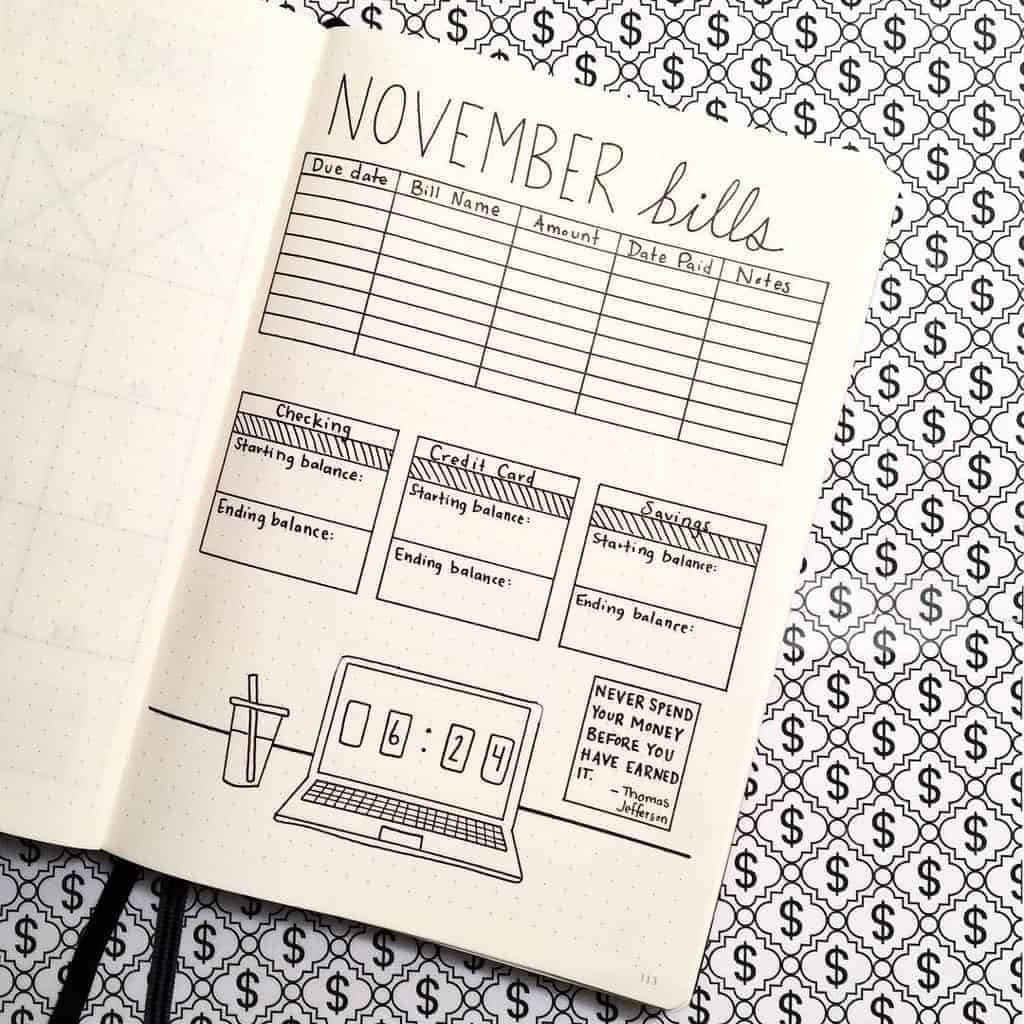

Beautiful minimal setup that is straight to the point. I feel like it’s perfect for such a serious page as boll tracker.

I also really like the doodles and the quote on the page – it’s such a great reminder to control spendings.

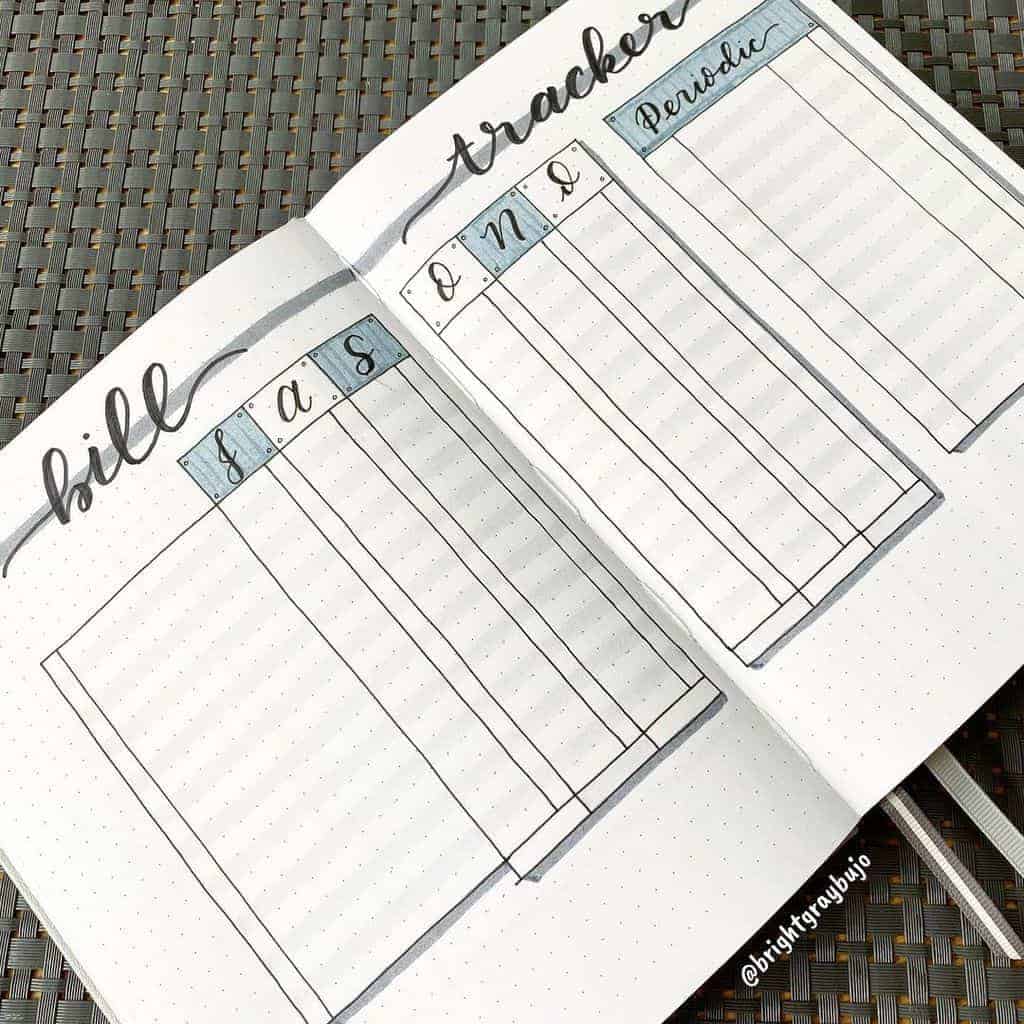

I really like this one because it doesn’t really limit you to having the same bills every month.

You have a lot of space on the left, so if you have different bills, some not on a monthly basis, you still can fit them all here.

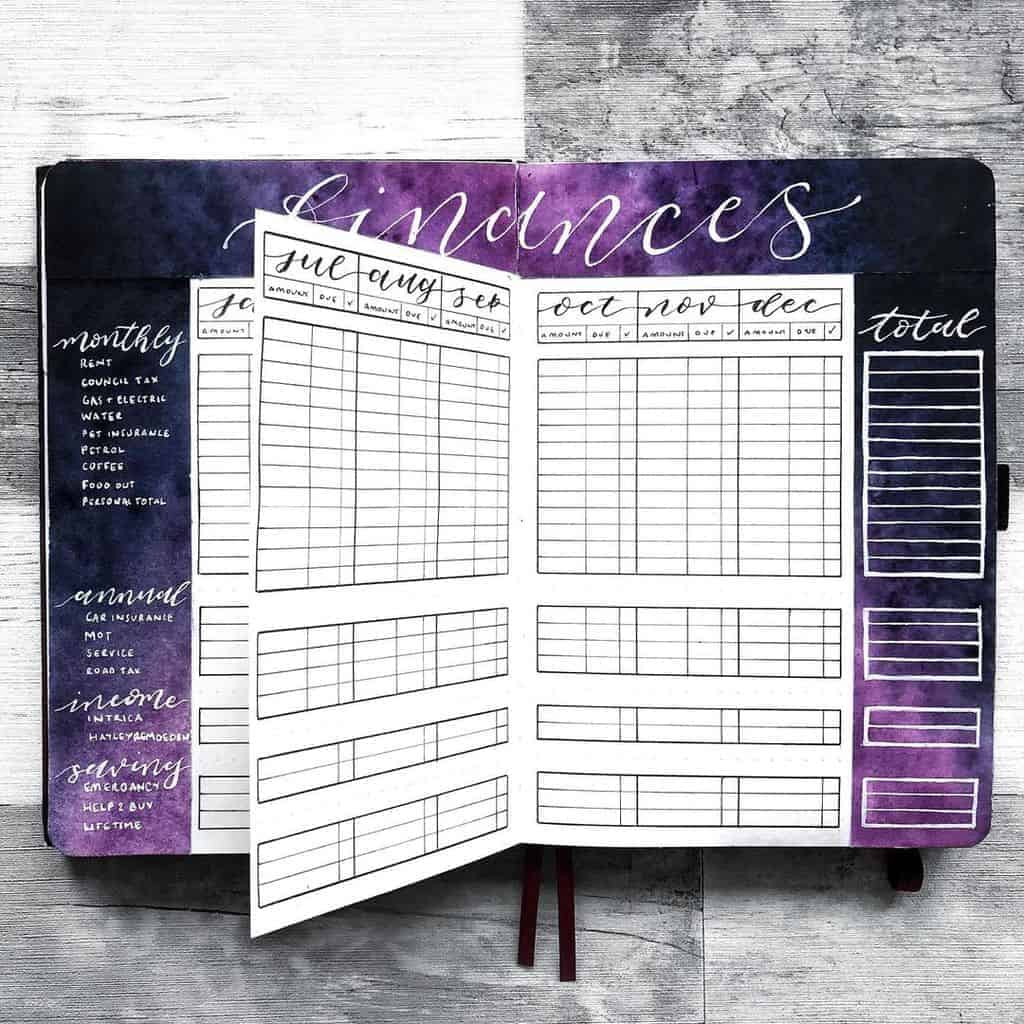

Hayley always has the most magical and beautiful pages; her watercolor borders here are incredible.

This is another example of a yearly bills tracker, but I love here that there are also other areas, like income and savings. It’s kind of a great yearly overview of finances.

A more strict way to divide your expenses – by creating separate boxes for each category.

For me, it’s not that good because it’s kind of not so good at coming up with exact categories, but if you already figured it out – this format will be perfect!

Before we go to the next page idea, I also want to mention that in my shop you can get some printable bill tracking stickers.

These fun little guys can help you easily stay on top of your finances and will make your page look good doing it!

Be sure to check my shop and, of course, let me know in the comments if you have any other things you’d like me to add there, like more printables or more functional stickers.

Budget Spread

Creating a budget is really the key to success.

It might take a while to figure out the exact number you might need in different spendings categories. And of course, you always have to be ready for some unexpected charges.

However, you’ll figure it out eventually as you keep your spendings tracker.

For your budget page, you might want to add not just assigned budgets to different categories, but also your income, total expenses, bills to pay. This will give you a more complete look at your finances.

Some budget pages also have a table with the planned budget and how much was actually spent. I think it’s a great idea since it will help you become more realistic with your budgeting.

Here are some budget spread ideas to inspire you to create your own.

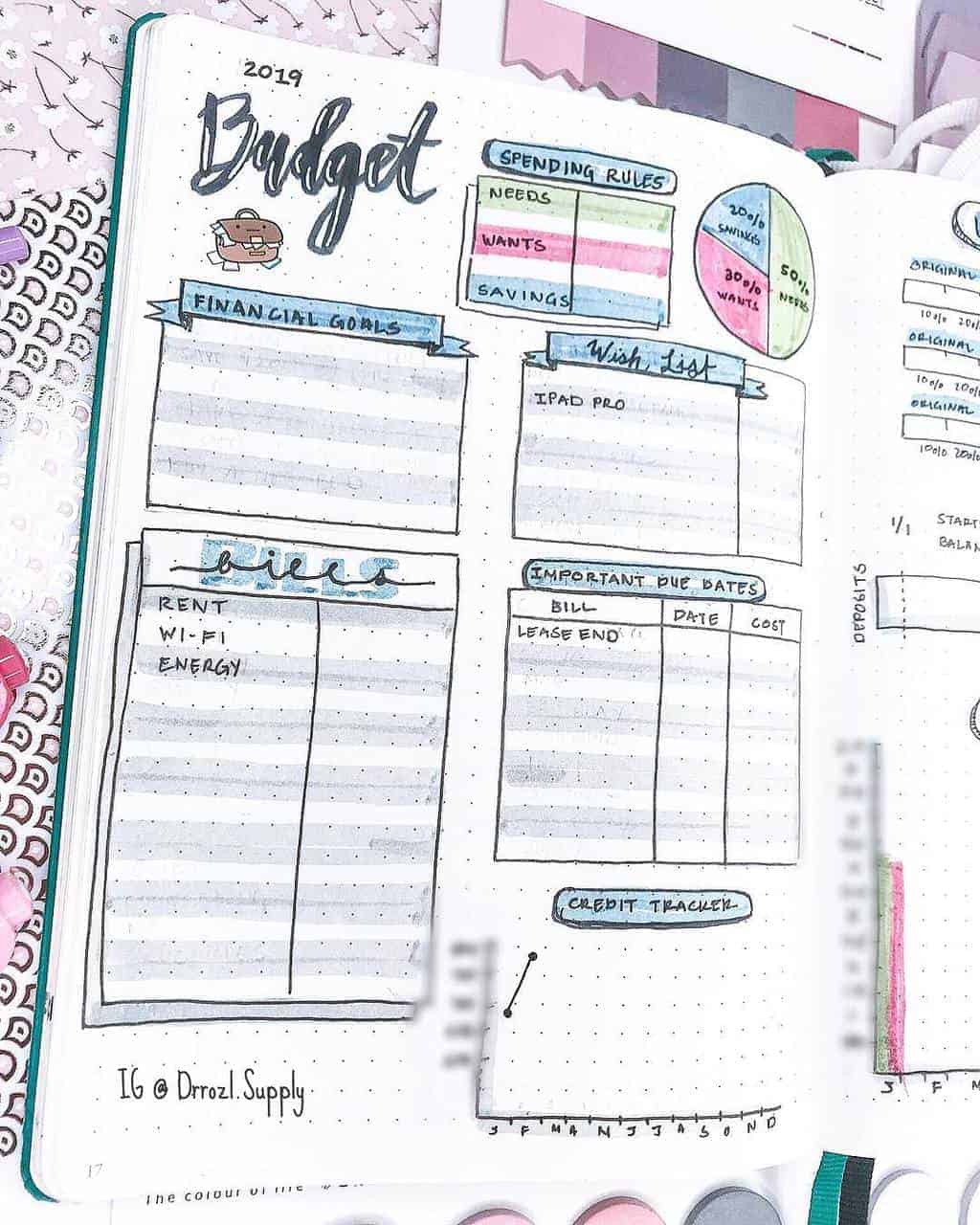

Such an amazing way to set up your yearly budget! This page really had a lot going for it.

You can see here yearly bills, spendings rules, a wish list, and of course – a planned budget on how much of your income should go for what.

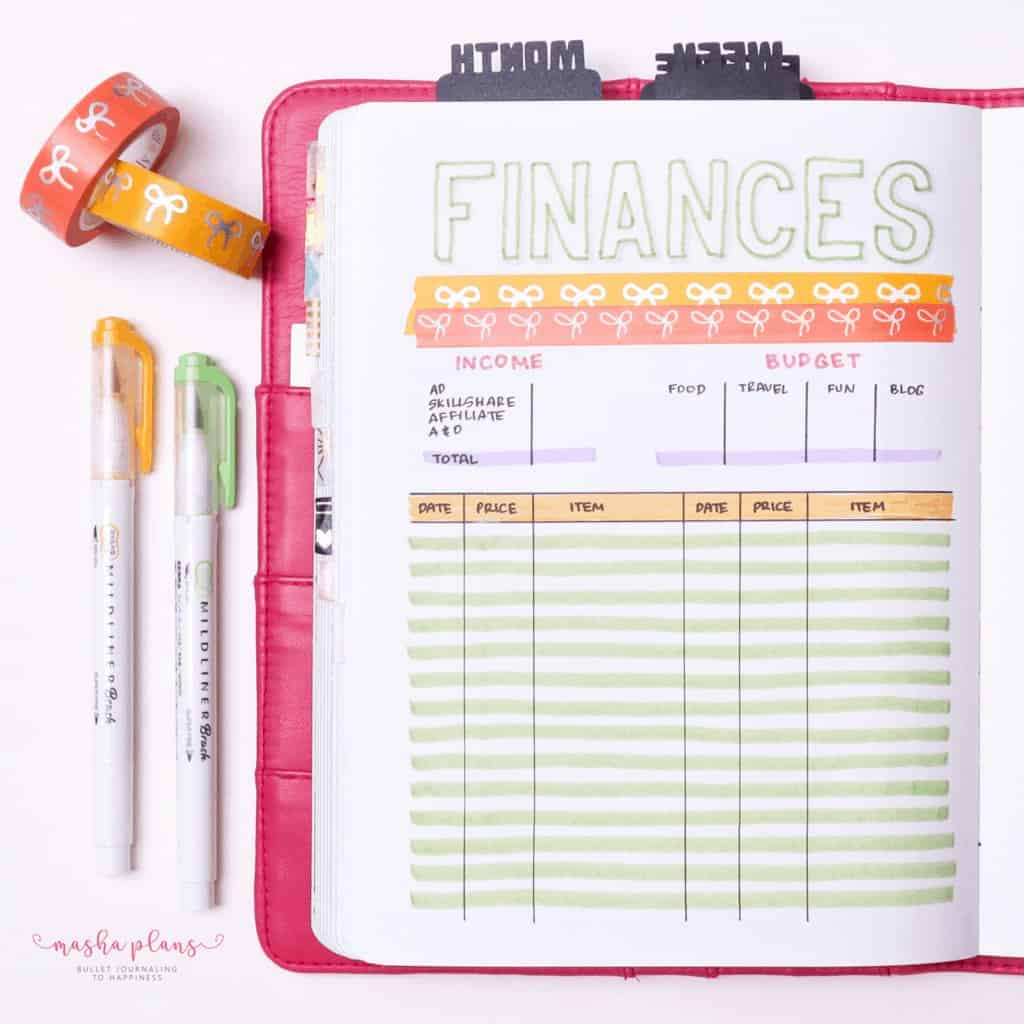

Love how happy and colorful this spread is. The bubble lettering is also great and I love that it has those little white lines to add more dimension to the letter.

I also like how there is the area for the budget and the area for the actual budget. We all know that things don’t always go according to plan, especially if we are talking about money. so it’s great to check yourself and see how far off your budget evaluation was.

Love this spread and the flatlay – they are so colorful and make me want to smile.

I also think it’s very useful to have the budget planned week by week; it’s a much easier thing to tackle.

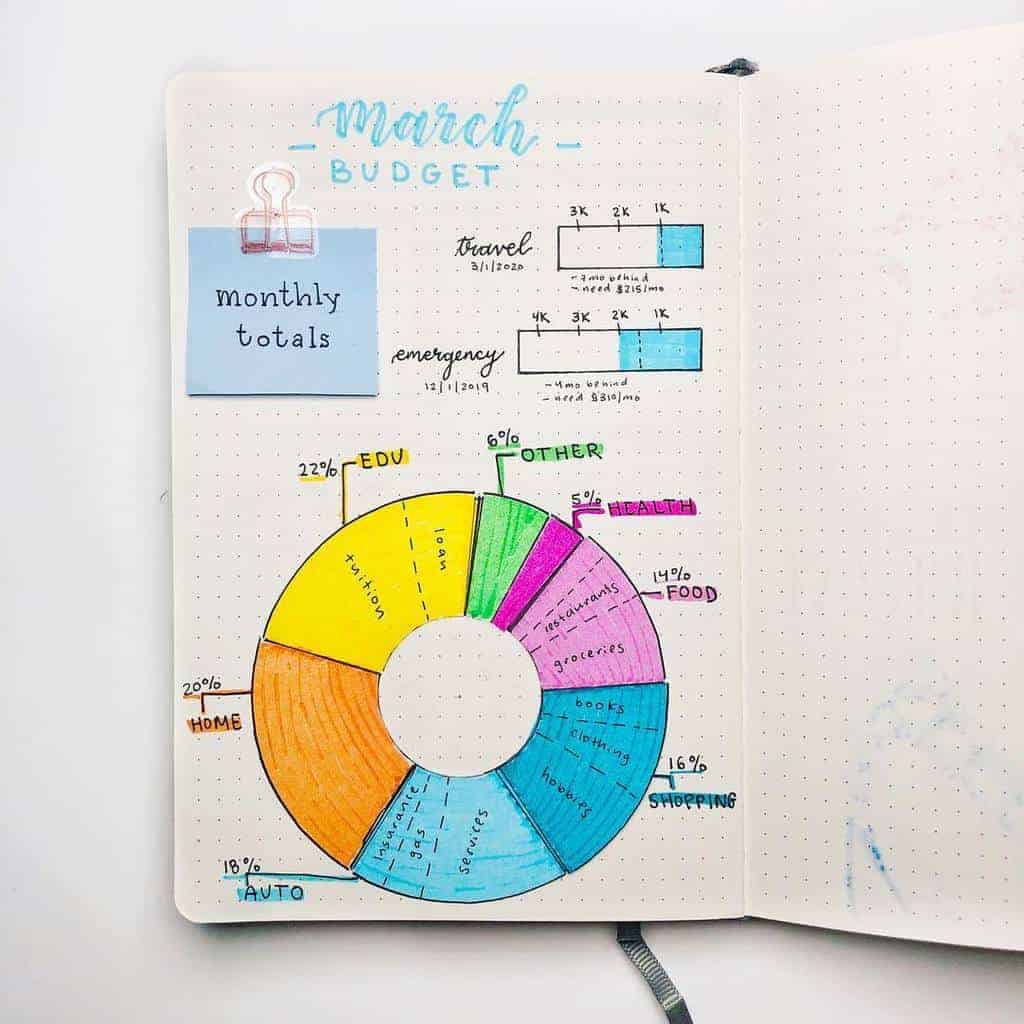

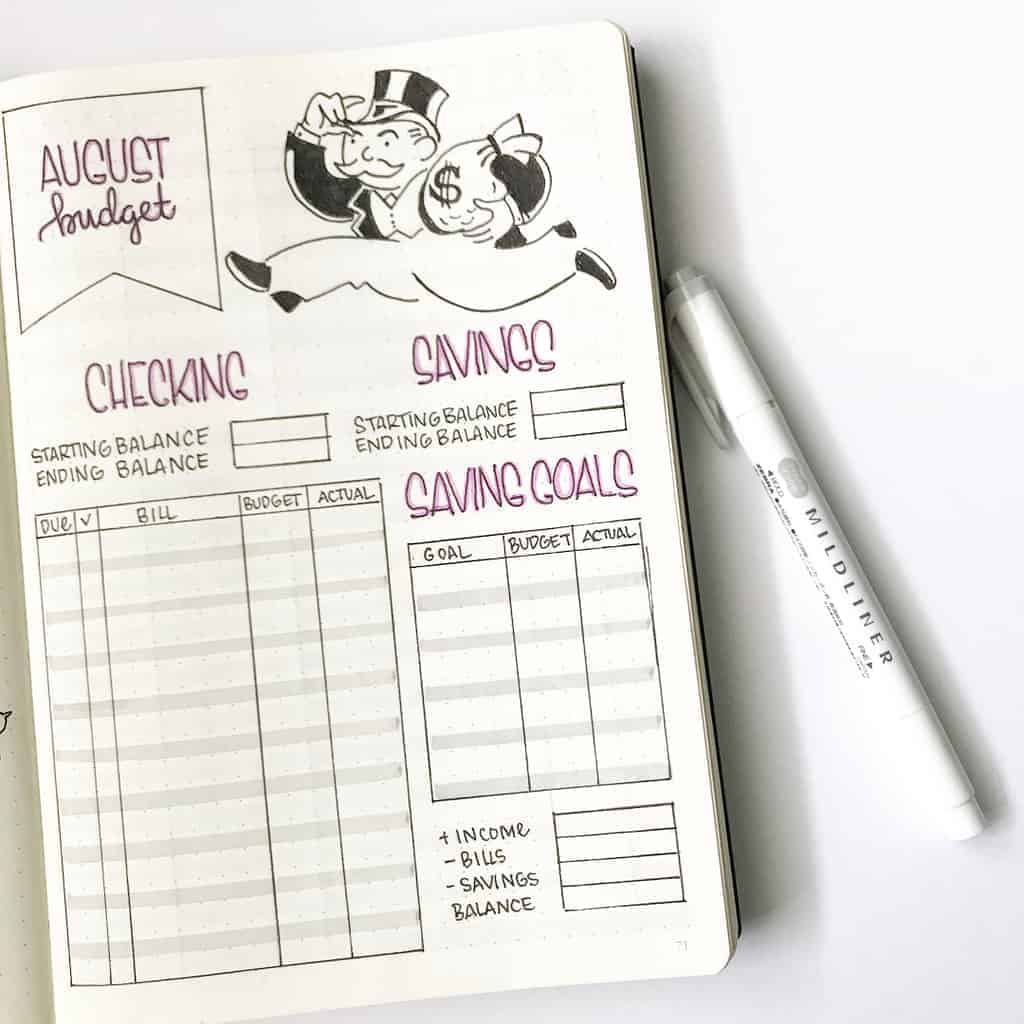

What an awesome and organized way to create a monthly budget!

I like that she has so many categories and even some subcategories for the monthly budget. Plus extra useful to have a budget for emergencies – you never know what can happen.

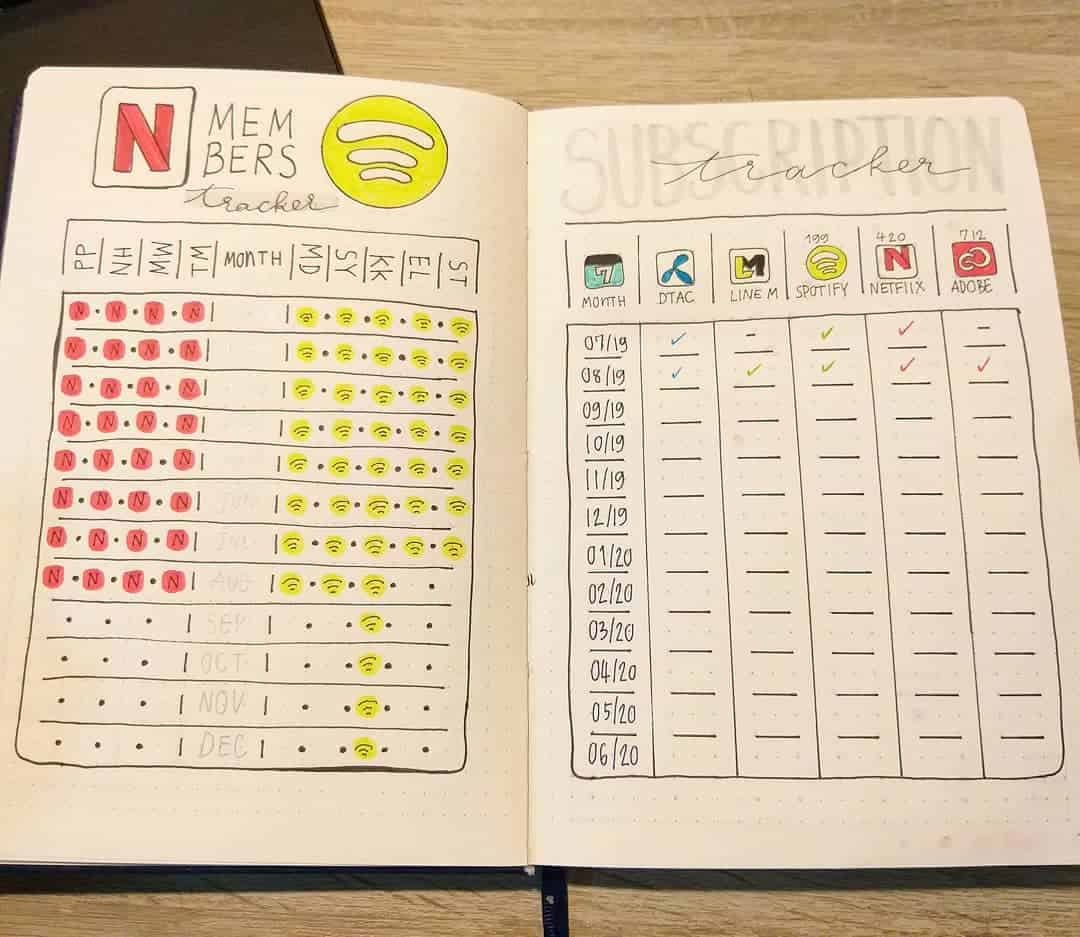

Subscriptions Tracker

How many subscriptions do you pay for? I can’t really remember them all.

Just for my personal use, I have Netflix, Amazon Prime, Disney Plus, Spotify, Headspace… I think I might be forgetting something.

Here is the deal – all those subscriptions that cost like $10-$15 each accumulate to a big sum and we don’t even realize it.

So try to do an audit of all your subscriptions, write down when and how much you have to pay. It will help you, first of all, to always pay it on time, but also maybe see that there are some you can cut off and save the money instead.

Or spend it on some cool stationery. Dealer’s choice!

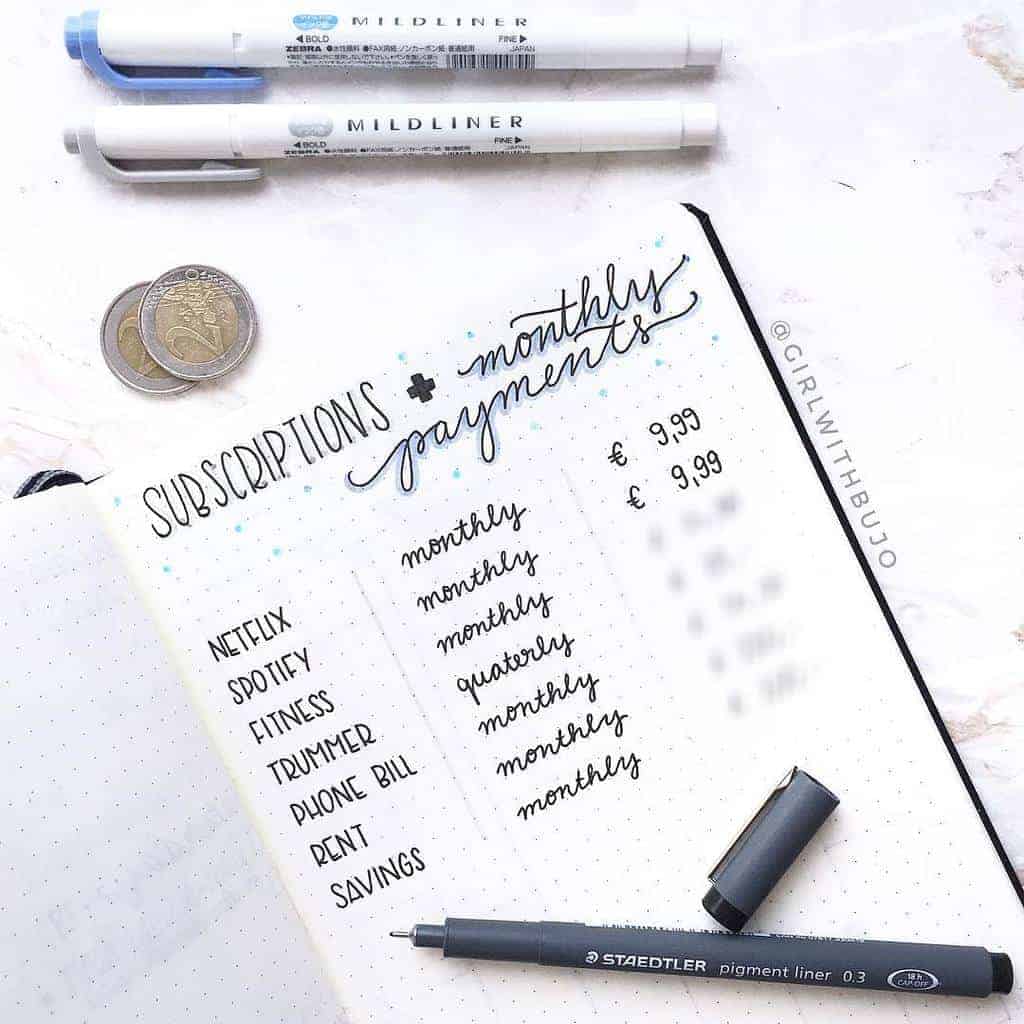

Beautiful tracker, I really love how minimalist Bullet Journal pages look so classy.

Also special prompts for adding auto pay function to this tracker. I feel like it’s very important since there are some subscriptions I need but also can’t auto-renew, so need to do it manually.

Great subscription tracker, and I love that it also includes the date each month the payment have to be covered.

Also, I love the use of color. It helps to divide the different subscriptions, but also adds some fun to the page.

Love this tracker and that it has icons for all the subscriptions.

I’m not sure what exactly the left page is though. let me know in the comments if you understand that one!

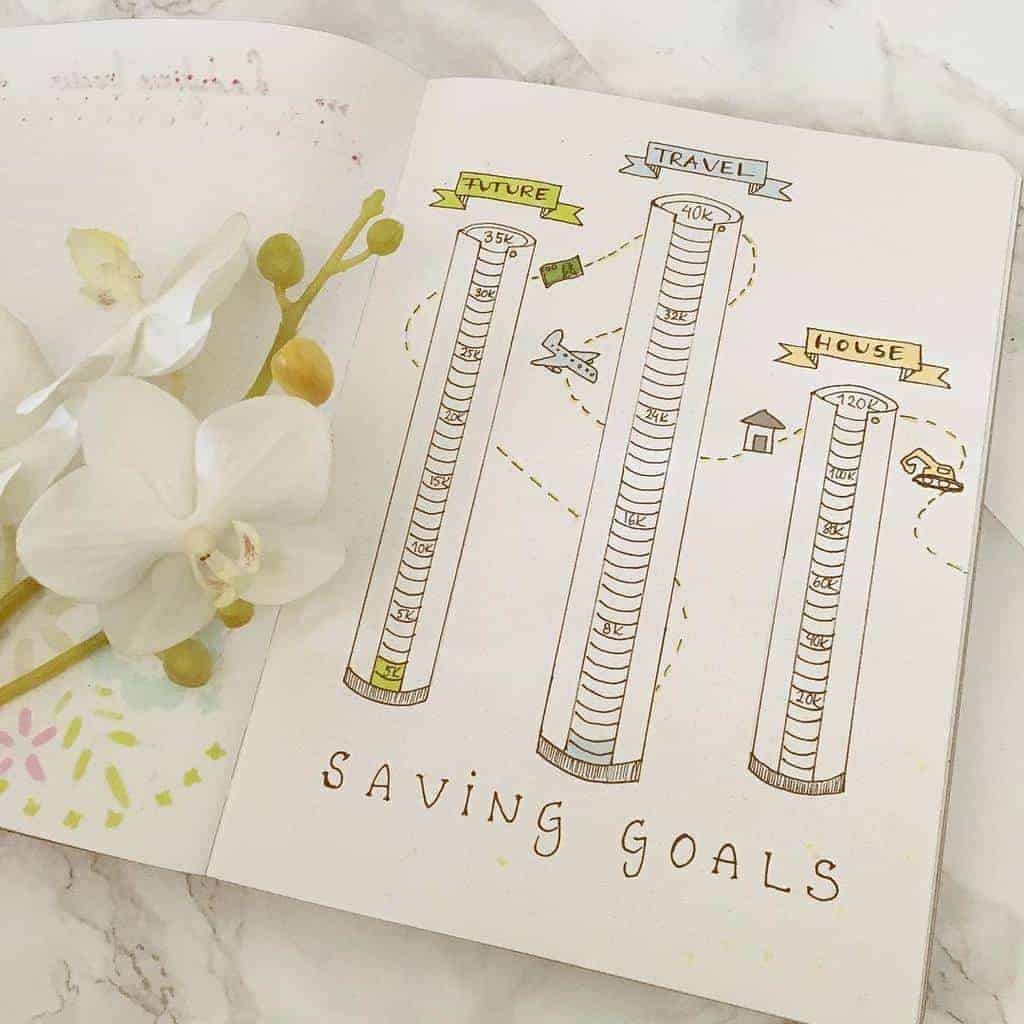

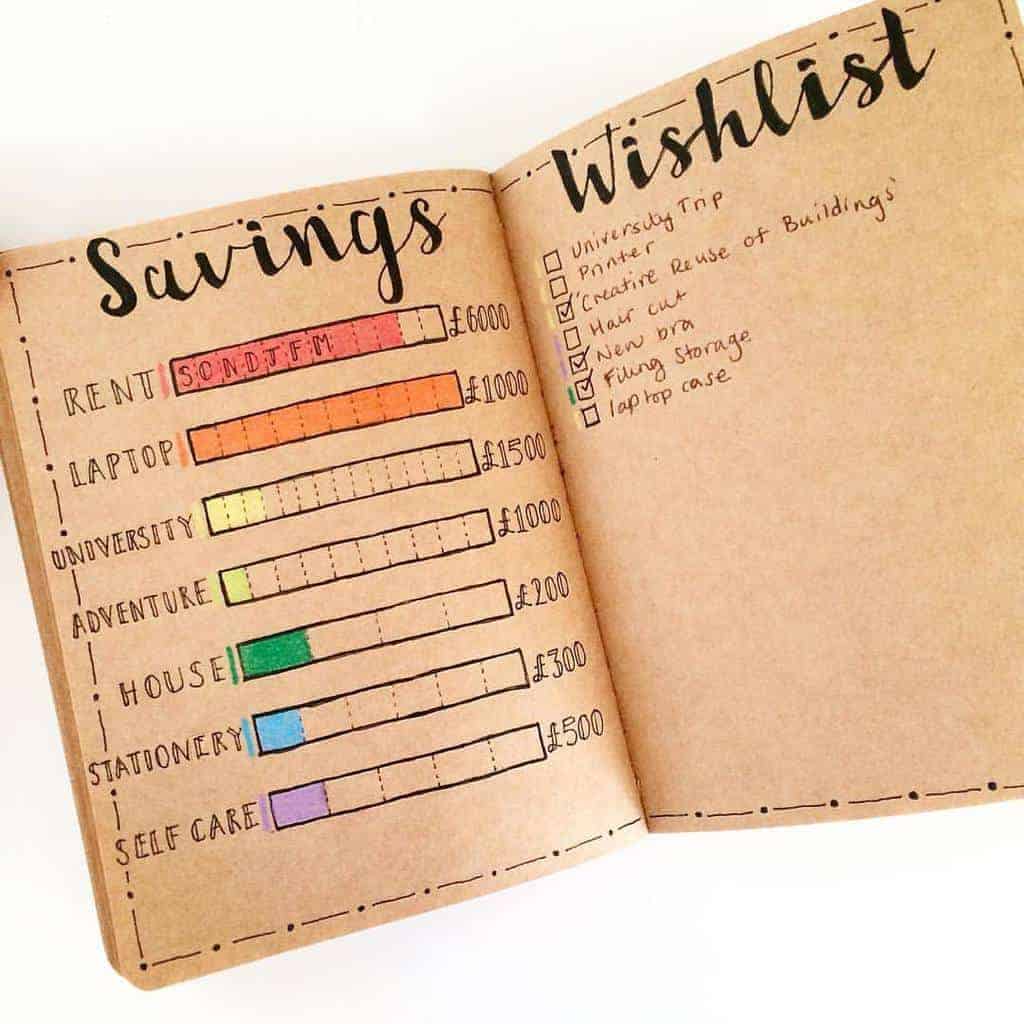

Savings Tracker

One important thing I learned when I started my adult life – you need to have savings. You never know when the universe will decide to mess with you, so it’s better to be always prepared.

Little savings account for a rainy day is a must-have for everyone! My financial consultant (it’s a family member, I don’t think I’m super rich and fancy to actually get one) says that a good amount of money to have in your savings is enough for you to live comfortably for 3 months.

Once you have that in your savings account, you can invest the rest of the money and watch those bill signs go up!

But back to reality (I’m nowhere near close to having enough for 3 comfortable months!).

Saving might seem like a very sad and hard thing to do, but it really doesn’t have to.

Once you look at your expenses you’ll be able to see what are some things you can cut off or use less to save a dollar here and there.

You can also develop little habits like putting all your coins away for savings and then go change them for cash at your local Walmart.

The thing is savings is like everything else – you shouldn’t just cut off everything at once simply to save money, but you can grind and do little steps every day and eventually get to your savings goal, whatever it is.

I love this savings tracker because here you can see the goals.

It’s always easier to save up when you know what are your goals.

Very basic but extremely effective savings tracker.

With this tracker, you can color each time you put a bit of money into your account. This will be so satisfying, and it will also keep you motivated to keep up with your savings.

Very cool tracker, and I love how the colors play with the kraft paper.

Again I must say it’s so useful to have different categories for savings; it’s perfect to keep you motivated. Also, it’s clever to have a wish list on the other side – anything to motivate you not to spend money randomly.

I love this tracker not only because it has this classy-looking design, but also because of the way it’s organized.

Every day (or week) you save up just a little bit to see how it eventually accumulated to a larger and more significant number.

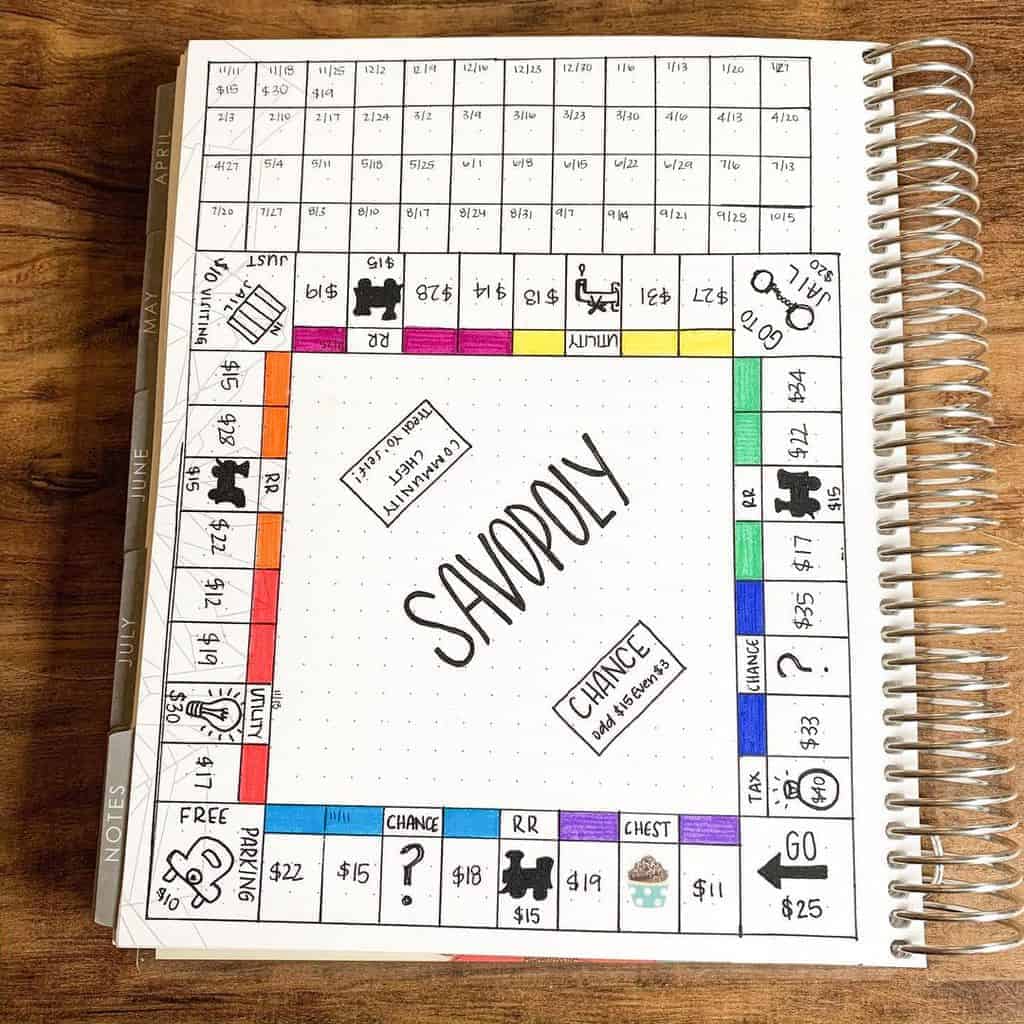

Such a fun way to start saving money – by playing games!

The way it works is pretty interesting – you roll the dice, move that many steps and that’s how much money you’ll have to transfer to your savings account.

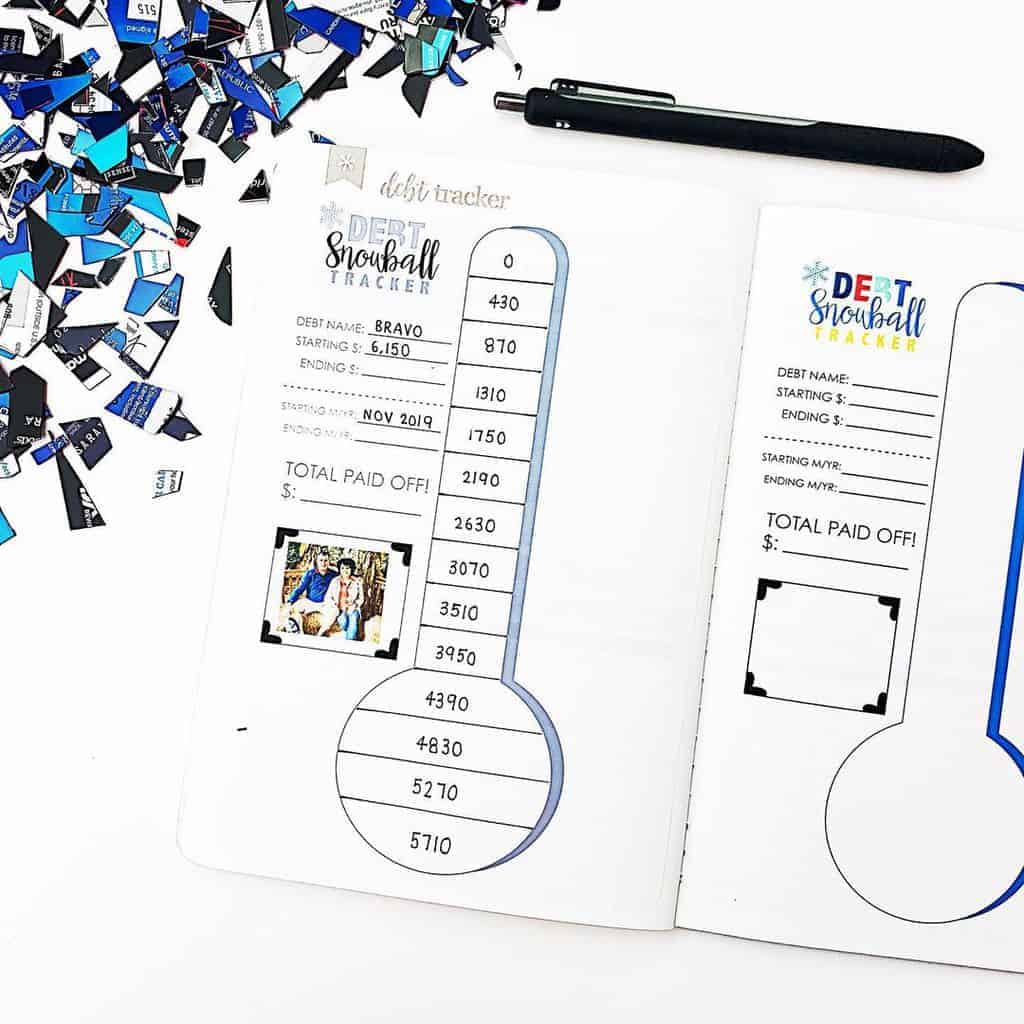

Debt Tracker

Being in debt is a reality right now, with mortgages, credit cards, and card payments. This is just the way life is.

You have to be however pretty careful with that to not go into too much debt! I know it’s very easy to do since, just like with subscriptions it sounds like a few extra dollars a month, but it all accumulates!

Plus you have to always be sure to pay up on time.

So a debt tracker is a very useful spread to have. It can also be motivating as you see how you till it out, and dollar by dollar, your student loans become smaller and smaller.

Monthly Finances Overview

This can be a cool little page to add to your journal just to see what’s up and stay on track with your expenses.

It doesn’t have a detailed spending tracker, but it gives you a good feel for how your month will go financially.

All you need is to have a small calendar and add their dates for your bills and paydays.

I also find it very useful to add the balance at the beginning of the month and the one you have at the end of the month, to see how you’ve been doing.

I love this beautiful spread and how it organically includes all you need to know about your monthly finances.

A cool idea is to use different colors in your calendar to mark paydays and bills. That way you can clearly see this from just one glance.

Beautiful page with an overview of a monthly budget.

It has pretty much all you need to see the outline of your monthly financial situation: bills, income, savings.

How clever is this idea to have the Monopoli man on your financial page!

I also like that there is so much space here for savings. I feel like saving money is so important that it does deserve more space.

No Spend Challenge

This page is more about saving money and I think that it’s a great way to challenge yourself.

Basically, try not to spend money for as many days as possible.

This will, first of all, help you to save up a lot. But secondly – it will help you to fix your spending habits.

Maybe if you don’t buy Starbucks every day and end up making your coffee at home, you end up liking it that way and keep this habit and those dollars.

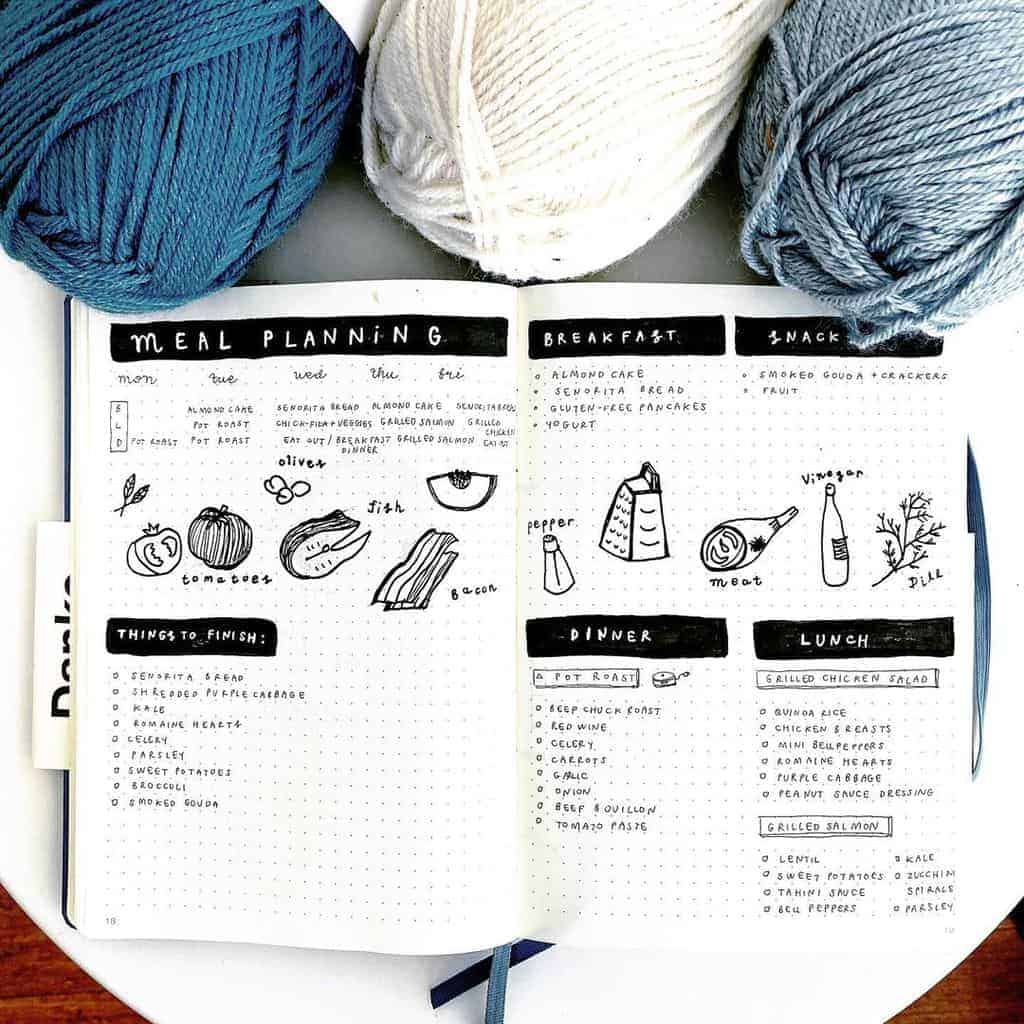

Meal Planning

Ok, this one seems like an odd one out, but if I learned something from my expenses tracking it’s that a huge portion of my expenses is for food.

Not knowing what to have for dinner and just ordering takeout is normal practice – I’m usually not even sure if there is anything to cook, so it’s just an easier solution.

All this means more expenses. I think you see now where I’m going with that.

If you have a plan and you have your shopping list you’ll end up not just saving up money by cooking, but also eating much healthier.

Beautiful meal planning spread; as you might know, white letters on black banners are my absolute favorite way to add interest to my headers.

I also like this page because it’s not as much of a plan for the week as it is a list of ideas, much more versatile.

A simple way to put the month of meal planning on just one page. Dinner is usually a difficult meal to plan so if you’re just starting with your meal scheduling plan just one meal a day for now. At least until it becomes second nature to you,

How do you track finances? Which pages helped you the most?

Will you be using any of these ideas?

Share with us in the comments!

Hope this post was useful; if you find it so, please share! If you enjoy my content and want to show your appreciation, please consider supporting me with a cup of coffee.

And remember: Keep Bullet Journaling, and Don’t Be A Blob.

I just found this today and I’m so happy! I am going to piece together some of these plans and hopefully it helps me get out of debt! LOL – well, at least I can be creative!

This is always such a hard task, wish you all the luck! And I’m, loving your positive attitude =)

Great ideas! I’ve been looking for ways to organize my finances and this bullet journal budget tracker seems like the perfect solution. Thanks for sharing, Masha!

Thanks! SO glad to hear you found it useful =)

Great ideas! I’ve been looking for ways to organize my finances and this bullet journal budget tracker seems like the perfect solution. Thanks for sharing, Masha!

Happy to hear these ideas helped!